Introduction to Small Amount Payments

In today’s fast-paced economy, the concept of small amount payments has gained significant traction, especially with the rise of digital transactions and microservices. Small amount payments typically refer to low-value transactions that are often below a certain threshold, such as $5 or $10. These payments can be used for a variety of purposes, from purchasing digital content like music or e-books to tipping service workers and donating to charities. The ease of making these transactions has transformed how consumers engage with businesses and services. With the proliferation of mobile payment platforms and digital wallets, the potential for small amount payments is vast, and understanding their implications can help businesses optimize their operations and improve customer satisfaction.

Benefits of Small Amount Payments

Small amount payments offer numerous benefits for both consumers and businesses. For consumers, these transactions enable greater flexibility and convenience in managing finances. The ability to make smaller purchases without the need for cash or large minimum amounts can enhance the shopping experience. Additionally, consumers can easily experiment with new products or services without a significant financial commitment, encouraging them to try out new apps or platforms.

From a business perspective, accepting small amount payments can increase customer engagement and drive sales volume. When businesses allow for low-cost transactions, they tap into new market segments, particularly younger consumers and those who prefer digital payments. Furthermore, these payments can help businesses boost their revenue through the accumulation of small amounts that, over time, can lead to significant earnings. This flexibility can also enhance customer loyalty, as clients appreciate the convenience of making quick and easy transactions.

Challenges and Considerations

Despite the advantages, small amount payments also come with their set of challenges. Transaction fees associated with processing small payments can eat into profits, making it crucial for businesses to choose payment processors wisely. For instance, a flat fee for transactions can disproportionately affect low-value purchases, resulting in a loss for the seller. Businesses must evaluate their pricing structures to ensure that they can afford to accept small payments without suffering financially.

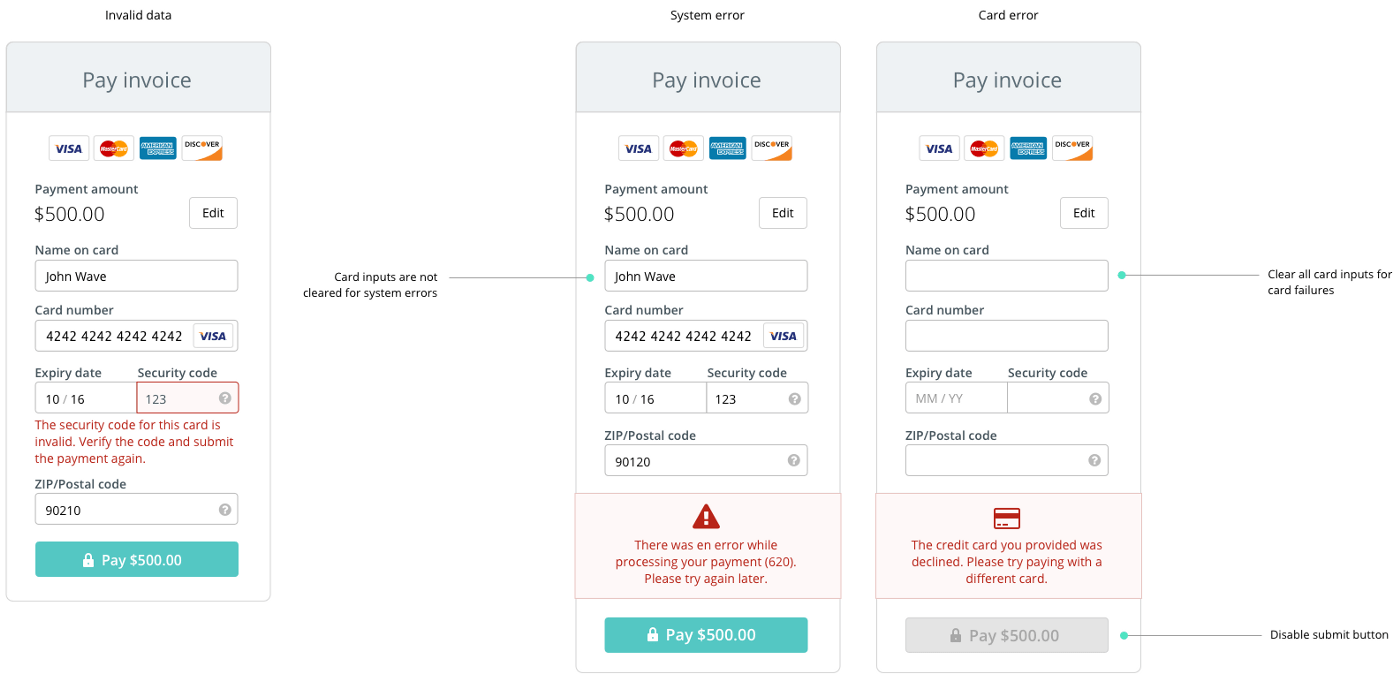

Additionally, security is a significant concern. Small amount payments can attract fraudulent activities, as some malicious actors exploit these transactions for illicit gains. Businesses must implement robust security measures to protect their customers and themselves from potential breaches. Ensuring compliance with regulations surrounding financial transactions is also essential, as failing to do so can lead to hefty fines and reputational damage. Therefore, while small amount payments can provide benefits, businesses must be strategic in their approach to mitigate these risks.

Future Trends in Small Amount Payments

Looking ahead, the future of small amount payments is promising. The increasing adoption of contactless payment technologies, such as Near Field Communication (NFC), is expected to facilitate even faster and more convenient small transactions. As consumers grow more accustomed to digital payments, businesses that embrace these trends will likely see an increase in customer satisfaction and loyalty.

Additionally, advancements in artificial intelligence and machine learning could lead to personalized payment experiences, enabling businesses to offer tailored promotions and incentives based on customers’ spending habits. Subscription models are also gaining traction, allowing consumers to make smaller, regular payments for services and products they use frequently. As the digital landscape continues to evolve, the importance of small amount payments in the overall payment ecosystem will only grow, shaping the way consumers and businesses interact in the future.

In conclusion, small amount payments represent a significant shift in the transaction landscape. Their benefits, challenges, and future trends are crucial for businesses and consumers alike to understand as we move toward a more digital-centric economy. Embracing these payments can lead to enhanced customer experiences, increased revenue opportunities, and the potential for innovative financial solutions in the years to come.컬쳐랜드카드결제